Investment Tips: Maximizing Returns in Epe’s Real Estate Market

Investing in real estate remains one of the most reliable paths to building long-term wealth, especially when done in rapidly developing areas. Epe, Lagos, is one such area that has quickly become a hotspot for savvy investors. With its strategic location, ongoing infrastructural development, and increasing demand for properties, Epe offers incredible opportunities for those looking to maximize their returns. In this post, we’ll explore key investment tips to help you make informed decisions and capitalize on the booming real estate market in Epe.

1. Understand the Market Dynamics

Before diving into any real estate investment, it’s essential to understand the local market dynamics. Epe’s transformation from a quiet town into a thriving real estate hub is driven by its strategic location and significant infrastructure projects, such as the expansion of road networks and the development of new residential and commercial areas. This growth makes Epe an ideal location for real estate investments, as properties are expected to appreciate significantly over the coming years.

2. Evaluate Potential Investments

When evaluating potential investments, consider factors such as location, future development plans, and current market trends. Two standout estates in Epe are Bona Fortuna Estate and Sola Fide Estate:

- Bona Fortuna Estate: Situated in Iwoye, Ketu, Epe, this estate offers plots of 500sqm for ₦9M and 300sqm for ₦5.4M. It’s a prime spot for both residential and commercial development, making it a top choice for investors looking to tap into Epe’s growth.

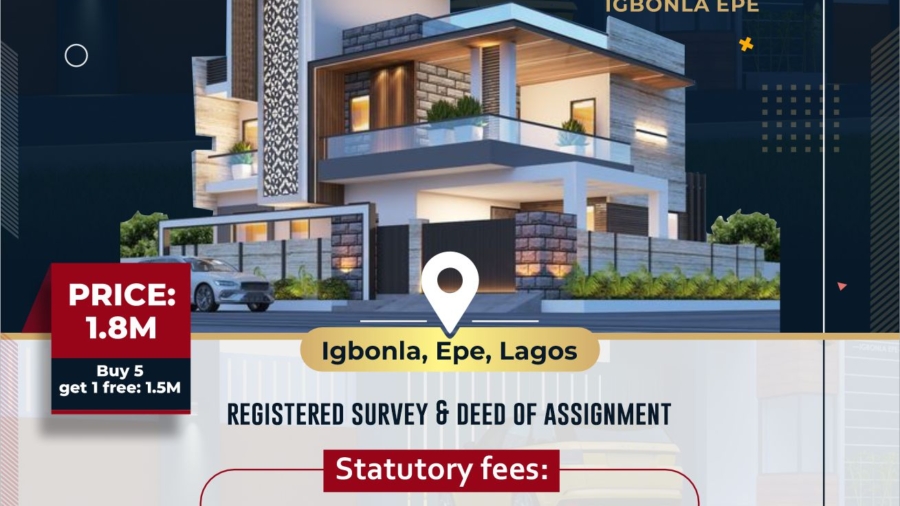

- Sola Fide Estate: Located in Igbonla, Epe, Sola Fide Estate provides plots of 500sqm for ₦3.5M and 300sqm for ₦2.1M. This estate is ideal for investors seeking affordable land in a rapidly developing area, with the potential for high returns as Epe continues to grow.

These estates are strategically positioned to benefit from the ongoing infrastructural developments in Epe, making them attractive options for those looking to secure prime real estate at competitive prices.

3. Diversify Your Portfolio

One of the golden rules of investing is diversification—spreading your investments across different assets to reduce risk and increase potential returns. In real estate, this means not putting all your money into one property or estate. By diversifying your investments across estates like Bona Fortuna and Sola Fide, you can create a balanced portfolio with varying price points and opportunities for appreciation, minimizing risk while maximizing potential returns.

4. Focus on Long-Term Value

Real estate is typically a long-term investment, and patience is key to maximizing returns. Holding onto your property for a few years allows you to benefit from capital appreciation as the value of the land increases. Epe’s real estate market is still in its growth phase, meaning properties purchased today are likely to see significant value increases in the coming years, especially with the area’s ongoing development.

5. Leverage Professional Advice

Navigating the real estate market can be challenging, especially in a rapidly developing area like Epe. Consulting with real estate professionals like Round Peg Homes can provide valuable insights and strategies to ensure you’re making the best investment decisions. With our extensive experience in developing and delivering over 100 private properties across Nigeria, we can help you identify the most promising investments in Epe and beyond.

6. Consider Infrastructure Development

Infrastructure development is a key indicator of future property value. Epe has seen significant improvements in road networks, schools, and other amenities, making it a desirable location for new homeowners and investors alike. Estates like Bona Fortuna and Sola Fide are positioned to benefit directly from these developments, offering investors a higher potential for return on investment.

7. Maximize Returns with Strategic Sales or Leasing

Once your property has appreciated in value, consider selling or leasing it out to maximize your returns. In growing areas like Epe, rental demand is expected to rise, providing a steady income stream for investors who choose to lease their properties. This strategy can help you generate ongoing revenue while still holding onto valuable real estate assets.

Conclusion

Epe’s real estate market offers incredible potential for returns, particularly in strategically located estates like Bona Fortuna and Sola Fide. By understanding the market, diversifying your investments, and leveraging professional advice, you can make smart investment decisions that yield significant long-term benefits. At Round Peg Homes, we’re here to guide you every step of the way, ensuring your real estate investments are both profitable and secure.

Ready to Invest in Epe?

Contact us today at Round Peg Homes to explore the best real estate opportunities in Epe and start your journey toward maximizing your investment returns.